cook county back taxes

When delinquent or unpaid taxes are sold by the Cook County Treasurers office the Clerks office handles the. Under the proposed relief ordinance interest penalties for late payments of the second installment of property taxes which are normally due August 3 will now be postponed.

Cook County Gun Ammo Tax May Be Back Soon

CHICAGO CBS -- Cook County.

. Except in Cook County each county generally holds tax sales the fall of each year. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Duties and Responsibilities of the Cook County Treasurer.

What happens if you owe delinquent property taxes. Maria Pappas Cook County Treasurers. Search to see a 5-year history of the original tax amounts billed for a PIN.

Cook County Treasurers Office Chicago Illinois. 1 extended deadline passed. What is the due date for Cook County property taxes.

Cook County Property Tax Sale List Every year the Cook County Treasurers Office is required to conduct an annual tax sale and biennial scavenger sale of delinquent PINS and parcels. Once you search by PIN you can pay your current bill online or learn. Cook County Owes 79 Million In Unclaimed Property Tax Refunds.

Every year your county collects state and local taxes. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Cook County guns and ammo tax struck down by Illinois Supreme Court is back on the books for now after Thursday board vote Alice Yin Chicago Tribune 1152021 After.

Struggling hotels malls owe Cook County millions in back taxes More than 500M remains outstanding after Oct. The Cook County Clerks office has a variety of property tax responsibilities. Cook County IL currently has 34730 tax liens available as of March 18.

January 13 2020 622 AM CBS Chicago. Billed Amounts Tax History. Cook County is the second-most populous county in the US and their previous system was considered too antiquated to meet the growing needs of the current tax.

Assessor Fritz Kaegi announces that property-tax-saving exemptions for the 2021 tax year are now available online. What is a property tax foreclosure. To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer.

It involves the Assessors Office the Board of Review the Cook County Clerk and the Cook County Treasurer. Cook County charges property taxes annually. Contact the county collector or county clerk within the county for tax sale information.

Ad Uncover Available Property Tax Data By Searching Any Address. The Senior Citizen Real Estate Tax Deferral Program. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of.

We Provide Homeowner Data Including Property Tax Liens Deeds More. Do You Have Money Coming. The Cook County property tax system is complex.

Ad Property Taxes Info. The due date for Tax Year 2021 First Installment is Tuesday March 1. The 2021 tax year exemption applications are now available.

Plus the Illinois Department of. Online Property Taxes Information At Your Fingertips.

Cook County Treasurer Maria Pappas Abc7 Chicago Host Black And Latino Homes Matter Phone Bank For Property Taxes Refunds Abc7 Chicago

Chicago S Cook County Board Rolls Back Tax On Sweetened Drinks Wsj

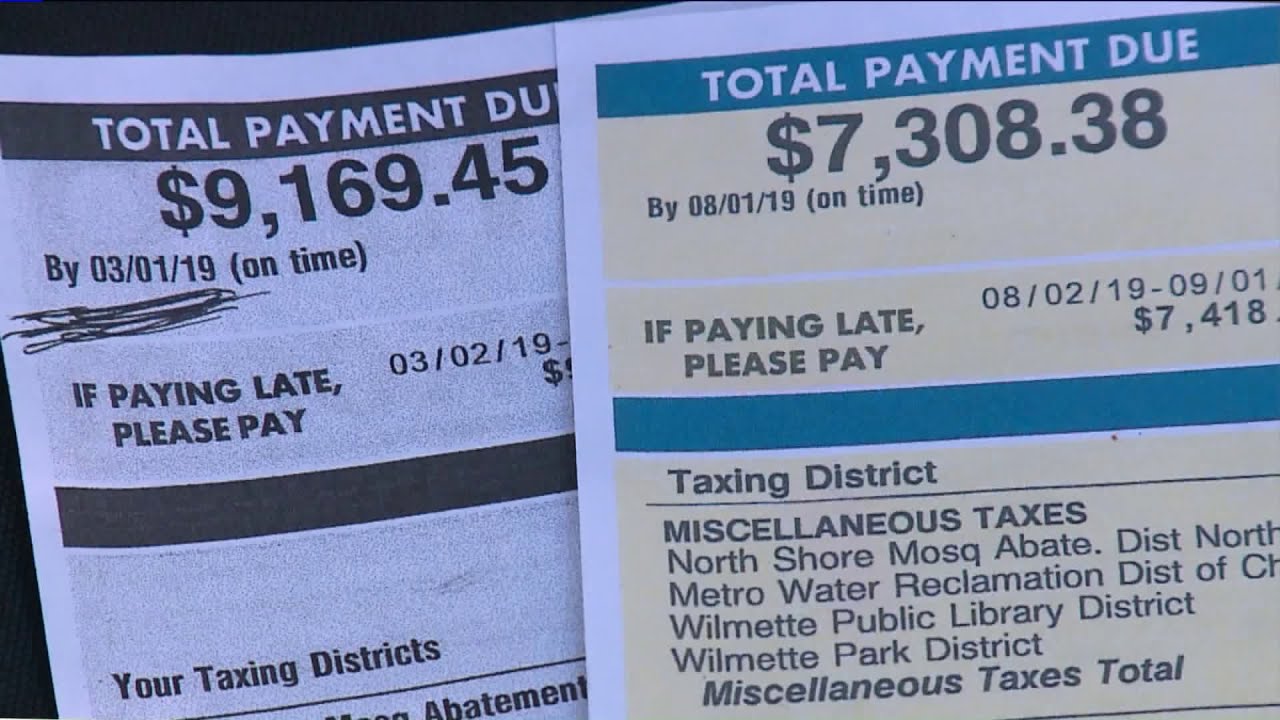

Cook County Property Tax Bill How To Read Kensington Chicago

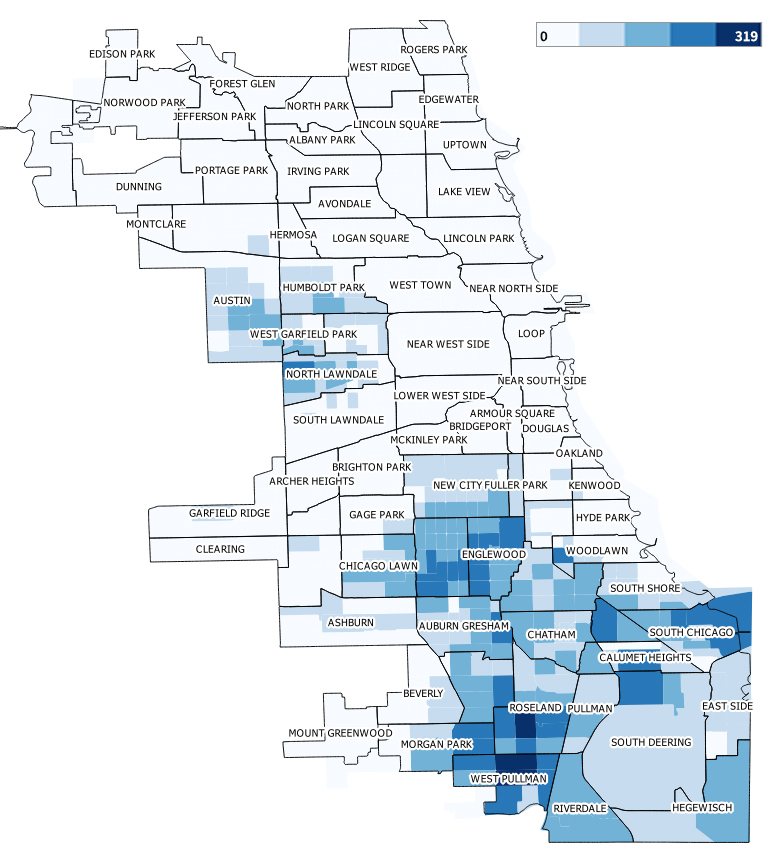

Column Property Tax Collection Data Show The Usual Suspects Are Lagging In Cook County Chicago Tribune

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Your 2020 Cook County Tax Bill Questions Answered Medium

How To Fight Your Cook County Property Tax Bill Youtube

Cook County Treasurer S Office Chicago Illinois

Cook County Property Tax Sale To Be Held In November Treasurer Maria Pappas Announces Abc7 Chicago