what items are exempt from sales tax in tennessee

1 Charge sales tax at the rate of your buyers ship to location. The Tennessee sales tax exemption for manufacturing also provides a reduced state sales tax rate to Tennessee manufacturers on purchases of energy fuel and water.

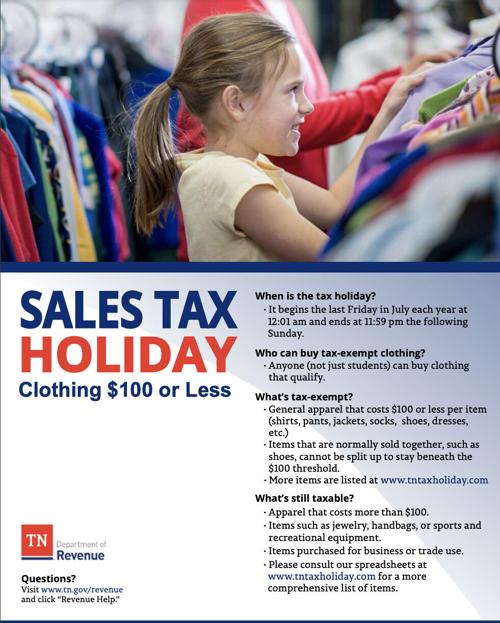

Tennessee Department Of Revenue Announces Three Sales Tax Holidays Clarksville Online

Sales or Use Tax Tenn.

. Tennessee does not exempt any types of purchase from the state sales tax. Several examples of of items that exempt from Tennessee sales tax are medical supplies certain groceries and food items and items used in packaging. What items are exempt from sales tax in tennessee.

What Canadian Businesses Need To Know About Us Sales Tax - Madan Ca. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the process of packaging. Groceries is subject to special sales tax rates under tennessee law.

Rental of rooms lodging or other accommodations for less than 90 consecutive days by people in the business of providing overnight lodging services. Sales tax-exempt items include clothing and footwear under 100 accessories and equipment under 50 school supplies and electronics. If the labor service is performed on real property the charge for labor is not subject to sales tax.

If youd like to find out the true meaning behind Walmarts codes abbreviations or how to duplicate a receipt read on. Several examples of of items that exempt from Tennessee sales tax are medical supplies certain groceries and food items and items used in packaging. Most items of tangible property are taxable in Tennessee.

Some goods are exempt from sales tax under Tennessee law. Groceries is subject to special sales tax rates under Tennessee law. All energy fuel and water purchased by Tennessee manufactures regardless of use is subject to a reduced state sales tax rate of 15 and 1 respectively.

Composition Books School supply. Here is a sample list of exemptions. What foods are exempt from sales tax in Tennessee.

This tax is generally applied to the retail sales of any business organization or person engaged. What is exempt from Tennessee Sales Tax. If you are a Tennessee business owner you can learn more about how to collect and file your Tennessee sales tax return at the 2018 Tennessee Sales Tax Handbook.

Clay School art supplies are exempt. Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials supplies and taxable services that are used in the performance of their contract to make improvements to realty. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments.

What are the three major types of entities or itemstransactions exempt from sales tax in Tennessee. Services specified in the law that are subject to sales tax in Tennessee include. You may be able to get a sales tax certificate or a sellers certificate same thing which exempts your business from sales tax for purchases that will be turned into products for resale.

All state and local governments non-profits resellers Governments federal. This means that an individual in the state of Tennessee who sells school supplies and books would be required to charge sales tax but an individual who owns a store which sells groceries medication is not required to charge sales. Examples include some industrial machinery agricultural equipment fuel and medical supplies.

Restaurant meals may also have a special sales tax. All state and local governments non-profits resellers Governments federal. Apr 18 2019 If the item is on sale at a reduced price or with a store coupon issued by the seller sales tax is charged on the reduced price.

Does TN charge sales tax on labor. Charges for labor performed on tangible personal property car repair lawn mower repair etc are subject to sales tax Does TN have a sales tax. Groceries unprepared food is taxed at a reduced rate of 55 but are not completely exempt from sales tax as they are in many other states.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the process of packaging. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

These categories may have some further qualifications before the special rate applies such as a price cap on clothing items. Contractors generally owe sales or use tax on the purchase price of the materials even when contracted by tax exempt. The sales tax certificate doesnt apply to products that you buy for use within your company like copy paper and office equipment.

Providing parking or storing of motor vehicles in a parking garage or parking lot. We recommend businesses review the Tennessee Sales and Use Tax Guide beginning on page 56 to see which goods are taxable and which are exempt and under what conditions. Tennessee non-profits resellers Wholesalers resellers hospitals Retailers wholesalers all governments.

At a total sales tax rate of 9250 the total cost is 38238 3238 sales tax. 25 where the food tax is about 6. Exempt if 100 or less per item.

In Tennessee certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. In most states necessities such as groceries clothes and drugs are exempted. The state sales tax rate in Tennessee is 7000.

Furthermore each location may only. Clerical vestments golf clothing galoshes diapers swimsuits lingerie and underwear pajamas hats art pads lab coats altar robes and dozens of other items are specifically denoted as tax. 67-6-228 state and local sales tax rates.

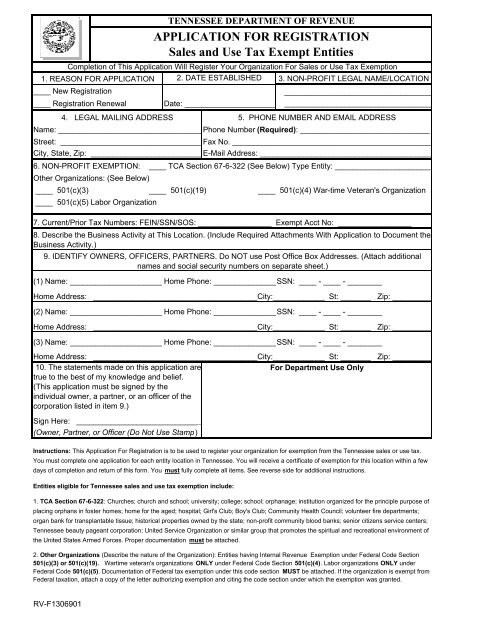

Tennessee Non Profit Sales Tax Exemption Certificate

How To Register For A Sales Tax Permit In Tennessee Taxvalet

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Is Food Taxable In Tennessee Taxjar

Tennessee Sales Tax Regulations On The Sale Of Farm Products A Program Of The Hal Pepper Financial Analysis Specialist Center For Profitable Agriculture Ppt Download

How To Register For A Sales Tax Permit In Tennessee Taxvalet

Tn Rv F1301301 2008 2022 Fill Out Tax Template Online Us Legal Forms

Business Guide To Sales Tax In Tennessee

Tennessee Sales Tax Regulations On The Sale Of Farm Products A Program Of The Hal Pepper Financial Analysis Specialist Center For Profitable Agriculture Ppt Download

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets

Historical Tennessee Tax Policy Information Ballotpedia

What Transactions Are Subject To The Sales Tax In Tennessee

Tennessee Sales Tax Regulations On The Sale Of Farm Products A Program Of The Hal Pepper Financial Analysis Specialist Center For Profitable Agriculture Ppt Download

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Tennessee Non Profit Sales Tax Exemption Certificate

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax Holidays Are Underway This Weekend In Tennessee News Timesnews Net